Block^H^H^H^H^HDistributed Ledger Technology

Published:

Last night, I went to the #InsurTechHfd meeting last night (March 14, 2019) at the Upward site at 20 Church Street, downtown Hartford.

The event was called Blockchain in Insurance, which I was interested in just because blockchain is one of several flavors of the month tech-wise. The other flavors, which I’ll probably opine on later, are artificial intelligence (AI), augmented or virtual reality (AR/VR) and internet-of-things (IoT).

Agenda

The original agenda for the event is screenshotted below. In the end, Matteo Carbone didn’t present and while Sujeesh Krishnan talked about Kinnami in the “Meet” session, he handed his seat on the panel discussion over to Christopher Chandler, the CTO and co-founder at Kinnami.

Geri Balaj

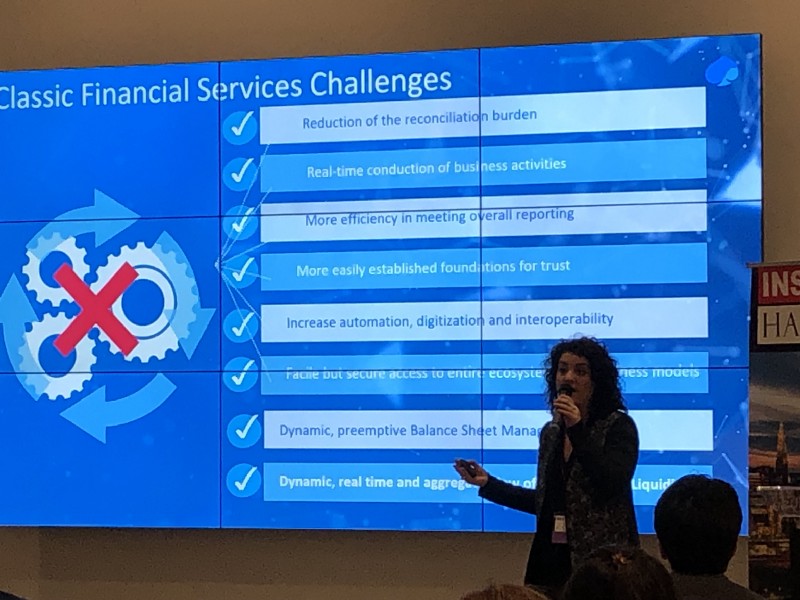

Geri is from Capgemini and has a long history of working in insurance technology.

Geri Balaj at the #InsurtechHfd event.

Geri Balaj at the #InsurtechHfd event.

The two refreshing things I heard from Geri’s talk were

- the use of the term distributed ledger technology instead of blockchain and

- that the business case / need must drive the adoption of distributed ledger technology, the technology can’t and shouldn’t.

The slide below shows some of the classical pain points for the financial services industry, and these are the things Geri believes will drive the adoption of new solutions, including distributed ledger technology.

Geri Balaj’s key fintech challenges.

Geri Balaj’s key fintech challenges.

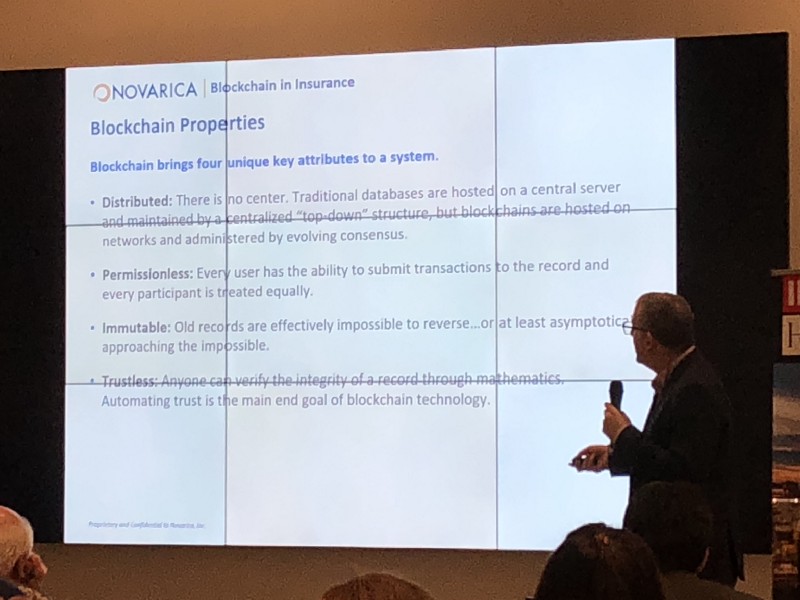

Jeff Goldberg

Jeff has a long history in data analysis and the associated technology. He, also refreshingly, was somewhat less than gung-ho about the adoption of blockchain in the insurance industry.

Jeff Goldberg’s key offerings by the blockchain technology.

Jeff Goldberg’s key offerings by the blockchain technology.

Jeff’s slide above was my key take-away from his talk. The four points that blockchain or distributed ledger technology offers.

Jeff was also the moderator for the panel discussion.

Meet Kinnami

Kinnami is a blockchain startup. They have several products, a key one is AmiStamp which uses blockchain technology to certify the validity of any electronic document.

.](https://kootsoop.github.io/images/1_duTE51rkBNWjURecM2woCA.png) Graphic of Kinnami’s AmiStamp from their website.

Graphic of Kinnami’s AmiStamp from their website.

Panel Discussion

The panel discussion was interesting, because of the different backgrounds each of the panelists had:

- Susan Joseph’s background is on the legal and business needs in the insurance industry.

- Gary Finke’s background is in data analytics for the insurance industry.

- Joseph Rapisarda is currently a graduate MBA student at UConn and is working on a startup called FitTrek. FitTrek aims to allow people to present their health and fitness information to health insurers in a transparent and trustable way.

- Christopher Chandler hired Sujeesh as Kinnami’s CEO, after Chris had started the company. Chris is very much a technologist, but has good insights into insurtech.

Again, the key points of not being gung-ho and saying that the business case needs to drive the adoption of the technology were heartening.

Slide showing the intended panelists.

Slide showing the intended panelists. The actual panelists, Christopher Chandler on the right-hand end replacing Sujeesh Krishnan.

The actual panelists, Christopher Chandler on the right-hand end replacing Sujeesh Krishnan.

Summary

In all, I was impressed with the people at the event. I’ll see about attending more #InsurtechHfd events, the next one is a pitch event for startups.

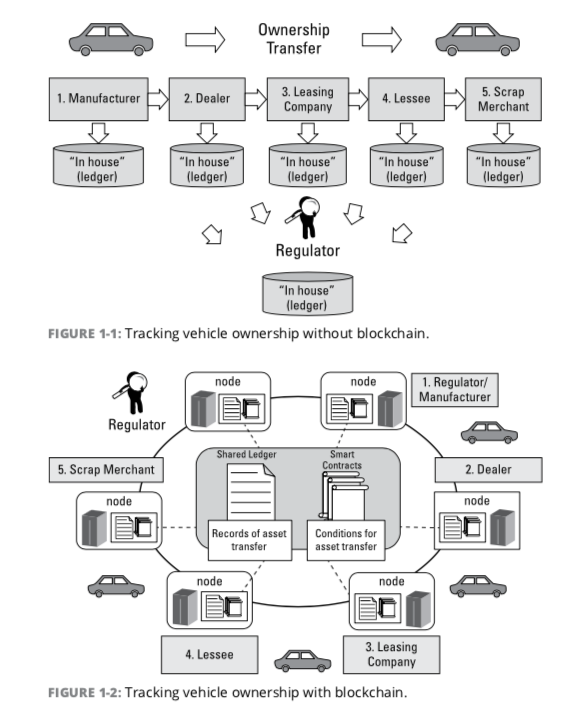

From what people said, it looks like IBM’s Blockchain for Dummies (PDF link) is right on the money.

Cover of IBM’s Blockchain for Dummies

Cover of IBM’s Blockchain for Dummies

In that booklet, they show an example of how auto (car) title might be simplified by using blockchain. Instead of relying on each step of the way having their own In House ledger, blockchain can be used as a shared ledger for all of them. This might also make regulatory oversight easier and cheaper.